Becoming an Amazon seller can be a lucrative pursuit, but you need to have the right accounting software to make sure you’re staying on top of sales tax.

The sheer amount of Amazon FBA accounting software out there right now is both a blessing and a curse. It is great that you have so many accounting software options to choose from, but how do you know which one is right for you?

If you’re feeling confused or overwhelmed by accounting software, then don’t worry, you’re in the right place!

In this guide, we will be walking you through our top ten picks of the best accounting software. We will take you through everything you need to know, including pricing, specific accounting features, and the pros and cons of each.

Let’s get into it.

Top Amazon Accounting Software Tools 2023

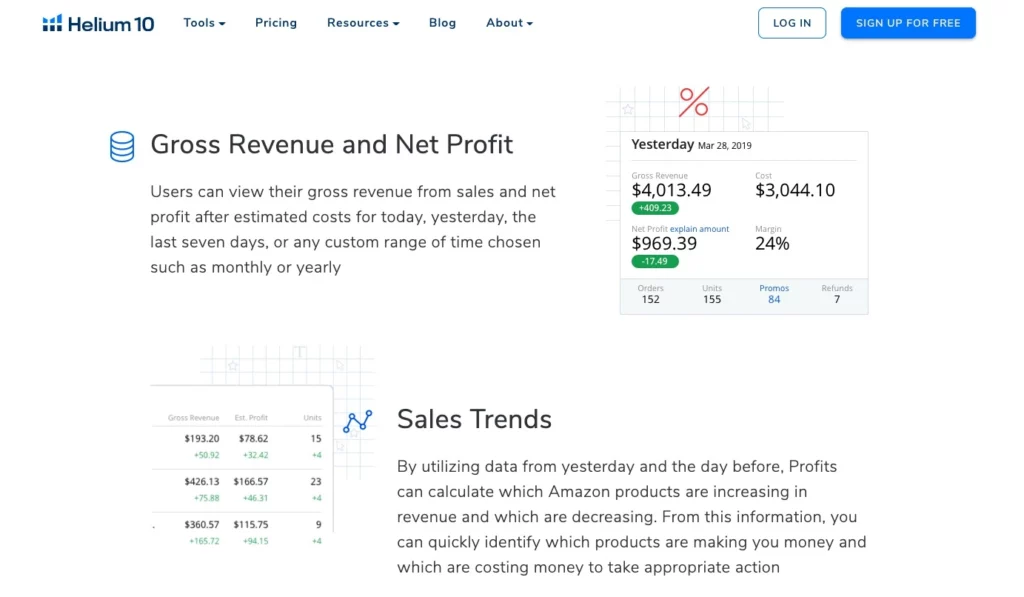

1. Helium 10 – Profits

Helium 10 Profits tool is top on our list as the best accounting software tool for Amazon sellers. Profits compiles multiple data points relevant to Amazon sellers to help improve their profits. As Helium 10 is one of the most popular Amazon accounting software available, it follows that Tools is jam-packed with features to increase the size of small businesses. Some of these features include keyword research, data relating to Amazon Marketplace sales, online accounting, and mobile apps compatibility.

Pricing Plans

Tools is part of Helium 10, so follows their pricing format. These are:

- Starter: $37 per month

- Platinum: $97 per month

- Diamond: $197 per month

- Enterprise: Custom pricing based on personal requirements

Pros

- Offers a complete portfolio of features beneficial to Amazon sellers

- Keeps track of key data relating to Amazon Marketplace transactions

- The accounting software for Amazon is well-designed and easy to use

Cons

- There is more powerful accounting software for Amazon out there, but it may not possess the same versatility

Verdict

Helium 10 is one of the most well-known and effective software available for Amazon sellers at the moment. It is packed with features for tracking sales tax and managing both your outgoings and incoming, in addition to essential keyword assistance, inventory management and Amazon sales!

Find out more about Helium 10 Profits

2. Fetcher

Second on our list is Fetcher. This accounting software is ideal for small business owners looking to expand into the world of Amazon business. Much of its purpose can be summarized by its name; Fetcher focuses on fetching relevant historical data and sales data relevant to your Amazon FBA business. This includes product costs, goods sold, and refund information, allowing Amazon sellers to better manage cash flow.

Pricing Plans

- Startup: $19 per month

- Business: $39 per month

- Enterprise: $99 per month

Pros

- Boosts Amazon sales by providing relevant financial reports of goods sold

- Makes staying on top of business finances easy via one simply interface

- All business expenses are accounted for, including Amazon FBA storage and labeling fees

Cons

- Does not account for sales taxes

Verdict

Overall, Fetcher is a solid cloud-based accounting software that can help you to improve your business accounting calculations. Its ability to track sales and business transactions gives you clear insight into where your money is coming from. It may not be the complete solution for larger Amazon seller accounts, but it could be just the thing for small businesses.

3. QuickBooks

Speaking of sales tax calculations, QuickBooks online offers everything you need for sales tax compliance. A variety of custom reports and receipts make for proper bookkeeping, which makes tax season a lot less stressful. You don’t need an accounting background to make use of QuickBooks online, either. The cloud based accounting software interface is simple to navigate and is among the easiest online bookkeeping available.

Pricing Plans

- Simple Start: $12.50 per month

- Essentials: $20 per month

- Plus: $35 per month

Pros

- QuickBooks’ integration works perfectly with mobile and multiple bank accounts

- Super cost-effective way to stay on top of online bookkeeping and invoicing customers

- High rated customer support team from reviews on Trust Pilot

Cons

- Potentially steep learning curve for new users

Verdict

The price point of QuickBooks desktop is accessible even for small businesses and amateur Amazon sellers. It is one of the most thorough accounting software for Amazon available and helps thousands of users every year through the sales tax period.

4. Xero

Founded in 2006 with the intention of assisting small businesses, Xero has come a long way. It now possesses over 1.8 million subscribers worldwide, assisting them with their sales tax calculation each year. Multiple Amazon FBA sellers can make use of this bookkeeping system through one account, depending on the subscription plan you pay for. Some of its key features include tax preparation, records of credit card payments, accurate financial reports, and supporting multiple users.

Pricing Plans

- Early: $9 per month

- Growing: $30 per month

- Established: $60 per month

Pros

- Highly effective software for Amazon sellers to organize their tax documentation

- Can be used on multiple platforms including mobile business apps

- Can be integrated with other accounting software built to support Amazon FBA account business

Cons

- Compared to other software for Amazon sellers, such as QuickBooks, Xero may seem a little simplistic

Verdict

Xero is highly effective software for Amazon sellers that allows you to track inventory management and sales with an intuitive interface. It may not possess the most complex range of features, but that could be the perfect thing for a small Amazon business looking to track income.

5. A2X

A2X stands out among other accounting programs on this list as it actually works in tandem with QuickBooks or Xero. It works to retrieve the latest Amazon transactions from your account and summarizes the necessary information into QuickBooks. This includes invoice creation and Amazon seller expenses updates.

Pricing Plans

- Mini: $19 per month

- Starter: $49 per month

- Standard: $69 per month

Pros

- Provides inventory valuation direct from your Amazon account

- Extreme accuracy to give you the latest information for building your Amazon business

- Completes your Amazon accounting automatically, so you can spend more time building sales

Cons

- No option to add manual entries, everything is automated

Verdict

A2X may be lacking in certain areas, especially if it isn’t linked to QuickBooks or Xero, but it still effectively allows you to manage your sales in an easy-to-understand format. Premium Amazon seller apps may offer more features, but for a small Amazon account, A2X has everything you need.

Find out more: A2X review.

6. Link My Books

Similar to A2X, Link My Books works in tandem with Xero to provide Amazon seller accounts with accurate bookkeeping services. It offers simplicity, which is a breath of fresh air given how complex bookkeeping through Amazon can get. Link My Books summarizes your sales, fees, and taxes, so you can easily upload them into QuickBooks or Xero for review.

Pricing Plans

- Lite: £8 per month

- Pro: £16 per month

- Premium: £31 per month

Pros

- Makes uploading invoices to Xero to QuickBooks easy

- Reduces the time ordinarily taken bookkeeping through automation

- Multi-currency support

Cons

- Exclusively supports European, North American, Japanese, and Australian Amazon business

Verdict

Link My Books is best used for Amazon FBA sellers that also use Xero or QuickBooks. It quickly and easily transforms your sales data into relevant invoices and documents for your records. Pairing your Link My Books account with either Xero or QuickBooks is simple, and can even be automated to save you even more time!

Read complete review of Link My Books

7. SellerBoard

For Amazon seller accounts seeking a user-friendly bookkeeping platform, SellerBoard could be a perfect choice. Its key features include a constantly updated data dashboard, credit card processing, restock alerts, inventory tracking, and refund management. Despite only being a recent startup, it is already making waves among online retailers.

Pricing Plans

- Standard: $19 per month

- Professional: $29 per month

- Business: $39 per month

- Enterprise: $79 per month

Pros

- Provides an entire portfolio of helpful features relevant to all Amazon sellers

- Includes live updates of listing changes

- Restock alerts allow you to keep on top of inventory(track inventory)

- Quality accounting software

Cons

- Unlocking full features could be too expensive for smaller businesses

Verdict

As a start-up, SellerBoard is impressive, but it does require some improvement. Further customization options could make a big difference to the user experience. For any Amazon sellers just starting out, however, SellerBoard has a lot to offer.

8. Taxomate

Speaking of sellers just starting out, Taxomate could also be an ideal option. It first launched with the intention of avoiding steep costs for online bookkeeping. It is intended to be used in conjunction with software such as Xero and QuickBooks. Its main features include sales data, tax records, and an intuitive interface.

Pricing Plans

- Starter: $9 per month

- 1K Plan: $19 per month

- 2K Plan: $35 per month

- 5K Plan: $49 per month

Pros

- Features a wide variety of customer support including email, phone support, and live chat

- Easy to set up and easy to use

- Highly affordable, even with premium packages

Cons

- Incompatible with QuickBooks desktop

Verdict

Taxomate is a strong addition to your Xero or QuickBooks account with a variety of features in its own right. It is easy to connect to your Amazon seller central account and provides you with a variety of metrics necessary to promote your sales.

9. TaxJar

Automation is key to TaxJar’s purpose. Sales calculations, reports, filings, and accounts payable are organized in minutes. It can be integrated with a variety of marketplaces including Etsy, PayPal, Amazon and Shopify. Essentially, this bookkeeping software is the perfect option for those looking to save some time when it comes to tax season.

Pricing Plans

- Basic: $17 per month

- Plus: Contact TaxJar for personalized pricing

Pros

- Almost all the processes are automated, so no confusing data sheets are involved

- Supports multiple marketplaces

- Automatically informs you of the storage taxes you may owe in each state based on specific warehouses

Cons

- No phone supported customer service

Verdict

TaxJar is a great option for those who want their tax data organized quickly and efficiently. It is a little short on additional features, but it achieves its primary goal well. Automated organization saves you ample time which you can put right back into your business.

10. Excel or Google Sheets

If you aren’t enthused by any of the Amazon FBA Accounting Software out there, why not go back to basics and use a free accounting software? Excel or Google Sheets both work perfectly well for staying on top of your tax details, provided you are organized enough to complete them. Luckily, there are numerous templates out there you can use for this very purpose, so you won’t be starting in the dark.

Pricing Plans

- Excel: $1.99 per month

- Google Sheets: Free

Pros

- The cost to use is exceptionally low

- Can be used/shared with multiple users

- Full customization over how you format your data

- Fully compatible across multiple platforms

- Ideal accounting system for a small business

Cons

- No specific features for bookkeeping/accounting software

Verdict

Excel and Google Sheets are both practical choices in their own right, but they aren’t bookkeeping software, which means you will be limited. Still, if you are a smaller ecommerce sellers who simply wishes to stay on top of tax data, they are perfectly viable options! You don’t need to pay out for software that you ultimately don’t need.

FAQ

What Accounting System Does Amazon Use?

Amazon sellers use an enormous variety of software for their individual pursuits. Many of the items featured on our list make up the most popular choices. Which one you opt for is down to your personal preferences! Compare product reviews if you struggle to make a final decision.

What is FBA Accounting?

FBA stands for Fulfilled By Amazon, which simply means the items you sell through Amazon arrive from one of their warehouses. FBA accounting simply refers to any financial bookkeeping related to Amazon FBA sellers.

How Do I Become an Amazon Sellers Accountant?

Start selling through Amazon and keep track of your own tax data.

There is no need to specifically hire an accountant for this process unless you represent a significant enterprise.

The accounting software for amazon listed in this guide provides you with more than enough features to adequately complete your own taxes!

What is the Best Accounting Software for Amazon Sellers Doing Their Own Bookkeeping?

In our opinion, the two best accounting software for Amazon sellers would be standout options are Fetcher or Xero with A2X integration.

Both of these choices feature a wide array of features that help to promote your business and keep you up to date with the latest product trends.

From double-entry accounting to keyword research, Fetcher and Xero provide you with everything you need to make a real profit through Amazon.

Amazon FBA Accounting Software: Final Thoughts

Now we have taken you through our top ten choices, it is time for you to make the final decision!

Remember, you have to take into account the size of your business before investing in accounting software. Do you have an accounting background or would you like the accounting software to do the heavy lifting for you.

Don’t go over budget with a premium plan when you don’t need it, but don’t undervalue your brand either! Be realistic and make the choice that most closely aligns with your intentions and scales with your business.

Good luck!