The internet has created lots of opportunities for people to sell goods and services across the globe without leaving their physical locations.

With many e-commerce companies trying to outdo each other in terms of quality services, retailers may have a tough time figuring out which platform would serve them best.

If you’re looking to sign up as a seller or retailer on an e-commerce marketplace, two of the most common options are Amazon and Walmart.

This guide compares Walmart vs Amazon – two of the world’s leading online marketplaces – to help you decide which platform is best suited for your brand.

Brief History of Walmart

Founded by Sam Walton in 1962, Walmart quickly grew to become the top grocery retailer in the United States.

After raking in more than $12 billion in sales, Walmart became a publicly-traded company in 1970, where its first stock sold for $16.50 per share.

The company launched walmart.com in 2007 to enable customers to buy items online and pick them up in brick-and-mortar stores. However, all that changed in 2016 when Walmart acquired Jet.com for $3.3 billion, jumpstarting its competitive advantage and becoming a strong online competitor.

With the acquisition, the company had all the necessary resources and framework it needed to expand its e-commerce business and go toe-to-toe with giants in the online marketplace, including Amazon – the world’s most popular e-commerce and shopping store.

Walmart is a multinational retail corporation, ranked #19 in retail brands and #103 in global best brands. It has a customer loyalty rating of 75%.

Brief History of Amazon

Jeff Bezos founded Amazon in 1994. The company didn’t start as a brick-and-mortar store. Instead, it launched as a full e-commerce store, with a particular focus on retailing books.

In the early 2000s, the company expanded its inventory and started selling a wide variety of products. It became the one-stop shop for just about anything consumers want to buy online. And it didn’t take long before Amazon was dubbed “The Everything Store.”

Amazon ranks #4 in Forbes 2020 Annual Most Valuable Brands and has an overall culture score of A-, and a customer loyalty rating of 68%.

Detailed Comparison of Walmart vs Amazon

With the brief histories out of the way, let’s now take a closer look at various aspects of these e-commerce behemoths.

Keep in mind that this comparison is not aimed at discrediting any of the brands. Instead, the goal is to give sellers a better understanding of the ins and outs of both platforms.

How Do Both Business Models Compare?

Compared to Walmart, Amazon has a more diversified business model owning the company’s digital advertising and web services.

For example, Amazon uses the Flywheel business model (also known as the Amazon Virtuous Cycle), designed to help sellers drive sales.

The Amazon Flywheel is essentially a strategy built around price value, and designed to leverage customer experience to drive traffic to the e-commerce site.

Here’s how it works: Amazon offers products with lower and more competitive prices, which are more appealing to potential consumers. This attracts more buyers to the platform and ultimately increases sales volume. In turn, more third-party sellers are drawn to Amazon.

In a nutshell, Jeff Bezos’ flywheel business model is self-sustaining and reinforces itself over time.

On the other hand, Walmart sticks to an everyday low price business model that insists on the least product costs. This means the company consistently scales volume to keep costs low, ensuring that customers get the best possible price for products.

While this is generally a good thing, especially for the consumer, it puts Walmart sellers on the 1P selling model in a tight spot.

They will have to offer the lowest possible price for products or else Walmart will consider them as holding excessive profit. This can end their business relationship with the mega-corporation.

Comparing Selling Options on Walmart vs Amazon

In terms of selling options, Amazon offers vendors the following to vendors:

- 1P Selling: This model allows vendors to sell their products to Amazon wholesale. This means Amazon handles everything from that point on (including housing, pricing, listing, and fulfillment).

- 2P Selling: Also known as Fulfilled by Amazon (FBA), this selling model allows vendors to sell their products directly to consumers while Amazon handles stores the products in its warehouses and fulfills all orders.

- 3P Selling: With this model, vendors merely use Amazon as a selling platform to reach a wider audience. The sellers are responsible for listing, pricing, product housing, and fulfilling orders.

With Amazon’s, vendors and brands can choose the selling option that best suits their product and shipping capabilities.

On the other hand, Walmart offers vendors the Walmart Fulfillment Service that goes toe-to-toe with Amazon’s FBA.

In addition to this, the company gives sellers a more flexible dropshipping option that combines the control of a 3P selling option and the convenience of a 1P selling model.

In this model, sellers are responsible for housing and shipping their products while Walmart takes care of product listing, pricing, and content.

Product Selection on Both Platforms

When it comes to product offering Amazon is significantly ahead of Walmart.

Walmart has about 75 million Stock Keeping Units (SKUs) in its marketplace. However, the corporation is continuously adding more products to this number every month, thanks to its increasingly rapid growth.

But Walmart’s product selection is far behind Amazon’s 350 million SKUs! That’s more than enough evidence that the company is truly The Everything Store.

Site Visits

Walmart gets 465 million visitors (64.8%) to its site through the direct channel. This is rather low compared to Amazon’s 5.7 billion (57.9%) direct traffic from desktops.

However, the reverse is the case when it comes to organic search traffic. Walmart takes the lead with 32% of visitors coming through organic traffic. Amazon has about 25% of site visits through organic search.

Market Share

The combined revenue of Walmart and Amazon was nearly $1 trillion in 2020. That’s a clear indication that these are the largest and leading retailers in the world.

However, a closer look shows that Walmart brought in $559 billion in 2020, while Amazon did $386 billion in the same period.

Statistics show that Amazon’s market share in North America amounted to 37.9% for online retail sales as of September 2020. In the same period, the online retail platform accounted for 9.8% market share in Europe.

Amazon has a global market share of 9.2% (retail sales shares) for 2020. This figure is slightly behind Walmart’s market share of 9.5% for the same period.

But when it comes to e-commerce shares, Walmart has only 5.6%, which is grossly below Amazon’s 51.2%.

Becoming a Seller on the Marketplace

Signing Up for Walmart

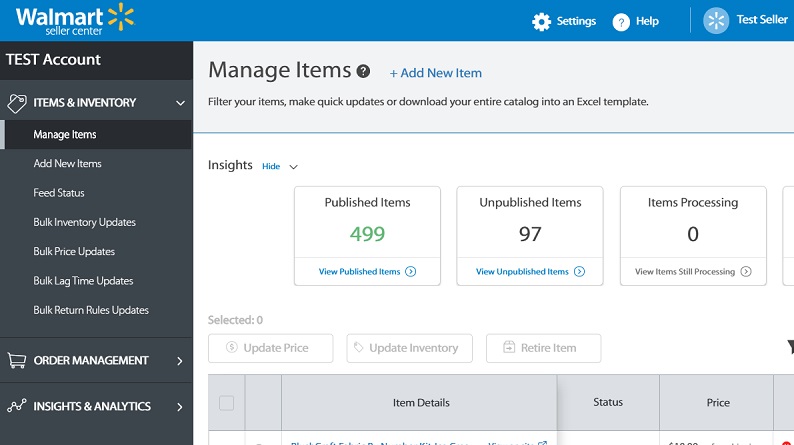

Getting into Walmart as a merchant is an uphill task, making it quite challenging for small sellers to successfully launch their Walmart stores.

Sellers must show that they have impeccable profiles to get in. The e-commerce company requires an on-time shipment rate above 99% and a defect rate below 2%.

In addition to this, sellers may need to wait for about two to four weeks to get invited to do business on the Walmart Marketplace.

On the plus side, getting started isn’t that problematic once Walmart approves a seller.

In a nutshell, you must have an excellent reputation on other platforms (eBay or Amazon) to get into Walmart.

Signing Up for Amazon

On the other hand, the sign-up process on Amazon is pretty straightforward. Unlike Walmart, you don’t have to undergo an approval process to sell on the platform. All a merchant needs to do is register an account as an Individual Seller or Professional Seller.

Signing up as an Individual Seller means you will pay $0.99 per item sold. It also has a per-item referral fee that ranges from 8% to 15%.

The Individual Seller account type limits sellers to only 40 listings. Merchants with this account will be charged fulfillment fees based on the size, weight, and category of the items.

The Professional Seller account type gives you unlimited listings. However, it comes with a monthly subscription fee of $39.00.

Listing Optimization

Both Walmart and Amazon allow sellers to optimize their listings to increase product discoverability.

For better results, online market platforms offer advanced listing options that allow sellers to add images, logos, product descriptions, module layouts, and even infographics. This increases the chances of landing sales.

Any seller on Walmart can access advanced listing options as long as they use Walmart Fulfillment Service (WFS).

On the other hand, advanced listing options are only available to branded merchants on Amazon.

Special Offers and Features

This part of the Walmart vs Amazon comparison looks at the various features available to sellers on both platforms.

Expectedly, Amazon’s features and offers are a bit more advanced compared to Walmart. That’s because the former has been in the e-commerce landscape for more than two decades before the latter come aboard.

Special Features on Amazon

Amazon’s special features include:

- Subscribe & Save: This feature allows sellers to offer a discount to customers who opt for regular item shipments.

- Buy Box: With this feature, customers can easily discover products and quickly add them to their shopping cart. The Buy Box is a big deal on Amazon, and every seller will love to have it, as it makes their products easily discoverable.

- Revenue Calculator: This feature makes it easy for sellers to compare the different fees associated with the FBA selling model and decide whether or not to opt for it.

- Inventory Management: With the inventory management feature, sellers can quickly and efficiently process, store, and deliver products to customers.

- Product Bundles: This allows you to deliver several products together in one package, usually at a comparatively lower cost than what consumers would pay if they buy the items separately.

Special Features on Walmart

Walmart gives sellers the following special features to help them scale their online businesses on the platform:

- Subscribe and Save: This subscription service is similar to what’s available on Amazon.

- Buy Box: Similar to Amazon’s Buy Box feature, sellers can win this coveted piece of e-commerce real estate by offering highly competitive pricing for the specific product.

- Item 4.0 Spec: This tool allows sellers to increase the discoverability of their products on Walmart.

- Inflex Kit: This is a way of selling multipacks of a single product. It allows sellers to give customers discounted prices for bulk purchases or get complementary products. Similar to Amazon’s Product Bundle, the Inflex Kit on Walmart is a single item containing multiple products.

- Listing Quality Dashboard: The primary function of this feature is to help sellers optimize their product listings.

Selling on Walmart Vs Amazon: Benefits and Downsides

Online Popularity

Amazon takes the lead when it comes to online popularity. With roughly 2.4 million third-party merchants, it is glaring that Amazon has a robust platform that supports vendors from across the globe.

Both established and small brands flock to Amazon to remain profitable and stay relevant. In other words, you should consider doing the same if you are looking to succeed in e-commerce.

Amazon’s popularity is not unconnected to the fact that many consumers consider the company as synonymous with e-commerce. Many people tend to use Amazon as a research platform to compare product listing.

As one of the largest review sources, countless people usually read reviews on Amazon first to get a better understanding of the physical products they are looking at on brick-and-motor store shelves.

Offline Popularity

Walmart is the clear winner when it comes to offline retail.

With more than 11,000 retail stores across 26 different countries of the world, Walmart is hard to beat when it comes to brick-and-mortar retailing.

Amazon has physical stores in a few different cities in the United States, including San Francisco, Chicago, New York, and others. Still, the online e-commerce giant can’t come close to Walmart in the brick-and-mortar marketplace.

Walmart’s Growth Potential

In investing, well-established companies (blue-chip companies) tend to have a steady return on investment but low payouts. That’s because they have reached their peak growth level and stabilized.

On the other hand, newer companies usually pay higher dividends because they are still new with lots of growth potential. But they carry a higher risk level since they are not well-established.

Okay, what has this got to do with the Walmart vs Amazon debate?

A lot!

Amazon may be the blue-chip company when it comes to the online marketplace, but Walmart’s e-commerce growth rate is something any serious brand would want to leverage.

Amazon may be the go-to platform for many consumers when looking for a product, but in most cases, their next stop is Walmart, especially if they can’t find what they want on Amazon.

This creates a huge selling opportunity for vendors who sell products on both platforms. If your product is listed on both Walmart and Amazon, consumers can buy from you even if the product is out of stock on one of the platforms.

Keep in mind that the investing example above does not, in any way, suggest that Walmart is the new kid on the block in terms of retailing. However, considering the company only became serious about online selling in 2016, it is safe to say it is relatively new on the online marketplace.

Further Comparisons:

- https://infinitefba.com/amazon-fba-vs-dropshipping/

- https://infinitefba.com/amazon-vs-ebay/

- https://infinitefba.com/alibaba-vs-amazon-fba/

- https://infinitefba.com/alibaba-vs-aliexpress/

Stiff Competition on Amazon

While Amazon has the advantage of being incredibly popular in the online marketplace, it comes with a downside for vendors, particularly small businesses that are just starting on the platform.

It will be naïve for a new seller to expect low competition on Amazon.

If anything, the opposite is very true.

You need to think up different marketing and sales strategies and find the most effective ways to implement them. That’s the only way to stay ahead of the hundreds and possibly thousands of other retailers selling the same products as you on Amazon.

With only about 50,000 vendors on Walmart, it is a lot easier for new brands and sellers to gain visibility on the platform.

And with more visibility combined with competitive pricing comes the chance to win the Buy Box!

Besides, Walmart has a stricter entry requirement for sellers as earlier mentioned. This means its doors aren’t as wide open to every merchant.

That’s a good thing for sellers who passed Walmart’s scrutiny because they will have less competition on the platform and have better chances of standing out.

Final Verdict

Now that you’ve learned about both e-commerce giants, which marketplace is right for your online retail business between Walmart vs Amazon?

While the answer might be mostly a matter of personal preference, here’s our expert opinion.

You really don’t have to choose one over the other!

It definitely won’t hurt to sell your products on both the fastest-growing e-commerce platform (Walmart) and the biggest e-commerce platform on the web (Amazon).

The key is to figure out which products and brands are best suited for which platform and then promote them accordingly.

Reference Articles